Twitter has sued Elon Musk, accusing the world’s richest man of violating his $44 billion agreement to buy the social media platform.

On Tuesday, July 12, Twitter filed the suit in Delaware chancery court to seek a ruling that would order Musk to complete the merger at the agreed price of $54.20 per Twitter share, according to a court filing.

Musk refuses to honour his obligations to Twitter and its shareholders because the deal he signed no longer serves his personal interests,’ the lawsuit states.

Last Friday, Musk said he was terminating the deal because Twitter violated the agreement by failing to respond to requests for information regarding fake or spam accounts on the platform, which is fundamental to its business performance.

The billionaire appeared to respond to the suit in a tweet on Tuesday evening, writing: ‘Oh the irony lol.’

Twitter’s lawsuit argues: ‘Having mounted a public spectacle to put Twitter in play, and having proposed and then signed a seller-friendly merger agreement, Musk apparently believes that he – unlike every other party subject to Delaware contract law – is free to change his mind, trash the company, disrupt its operations, destroy stockholder value, and walk away.’

Twitter’s General Counsel Sean Edgett informed staff of the lawsuit in a company-wide memo on Tuesday afternoon.

‘We have also filed a motion for an expedited trial alongside the complaint, asking for the case to be heard in September, as it is critically important for this matter to be resolved quickly,’ Edgett wrote in the memo, according to the New York Times.

At this point we anticipate the next step in the process will be for the court to set a schedule for the case,’ he added.

The lawsuit was a widely anticipated step after Musk last week announced his intent to pull out of the April 25 merger agreement, which specified penalties for backing out of the deal.

Those penalties included a $1 billion breakup fee, as well as the ability for the parties to enforce the contract in court, which Twitter officials had previously vowed to do.

Musk argues that Twitter has broken its contractual obligations by failing to disclose key information about fake accounts on the platform.

Twitter’s lawsuit will be heard in Delaware chancery court, as both Twitter and the company Musk is using to complete the merger are officially incorporated in Delaware.

The lawsuit accused Musk of ‘a long list’ of violations of the merger agreement that ‘have cast a pall over Twitter and its business.’

Shares of the social media platform closed at $34.06 on Tuesday, sharply below the levels above $50 where it traded when the deal was accepted by Twitter’s board in late April.

Musk said he was terminating the merger because of the lack of information about spam accounts and inaccurate representations that he said amounted to a ‘material adverse event.’He also said executive departures amounted to a failure to conduct business in the ordinary course, as Twitter was obligated to do.

Twitter said it negotiated to remove from the merger agreement language that would have made such firings a violation of the ordinary course requirements.

Twitter called the reasons cited by Musk a ‘pretext’ that lacked merit and said his decision to walk away had more to do with a decline in the stock market, particularly for tech stocks.

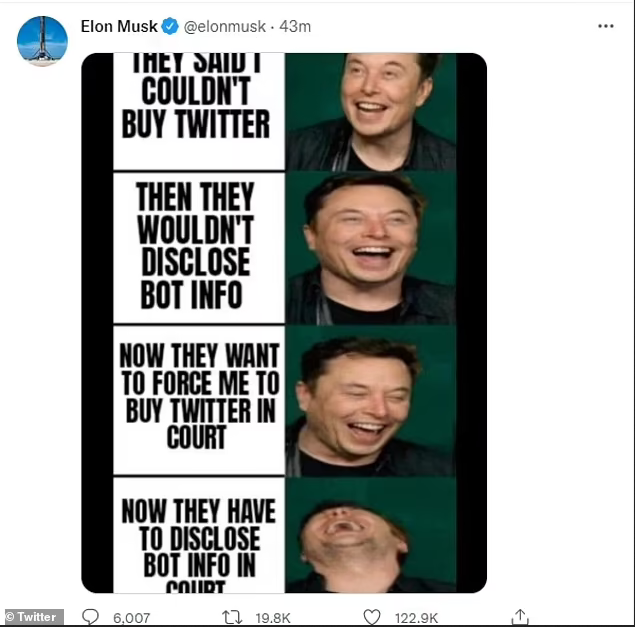

Musk has continued to launch many attacks on Twitter by tweeting a series of memes mocking the company for attempting to enforce the agreement.